Financial Inclusion

Globally, over 2.5 billion adults have no access to the types of formal financial services delivered by regulating financial institutions, leaving a huge gap that needs to be filled through innovative technologies and service models.

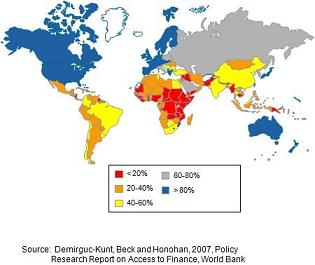

The figure below states worldwide statistics on households having a single bank account – great challenges and opportunities for Financial Inclusion.

Typically, financial inclusion can be started by providing access to banking accounts, microinsurance products, micro loans, remittances, and comprehensively spreading onto other financial services offered by the financial institutions.

However, Banks and Insurance companies often fail to deliver these due to the following constraints:

- Cost of processing a transaction is higher – typically, cost per transaction is over $1 to the bank branch, $0.40 at the ATM, and about $0.10 for internet

- Number of transactions are low

- The value of each transaction is lower, typically below $5

The customer is hesitant to reach out to an existing bank branch due to the following constraints:

- The cost of reaching a branch is high for a small value transaction, the cost of travel and the time taken to travel due to infrequent transport is a good portion of the transaction value

- Clash of branch timings and daily obligations of a customer

- Paperwork requires literacy and understanding

Besides, issues like availability of trained staff in remote locations and language of operations is a challenge.

These issues can be addressed through branchless banking/mobile banking which is a combination of Business Correspondent (Field Agent), and economic advanced solutions (biometrics, smartcards and GSM/CDMA/PSTN connectivity).

Integra is a pioneer in providing stable and secure technology and field services to enable Agent Assisted Banking, Insurance and Commerce services to the financially excluded population, while also enriching lives of the served and underserved masses, both urban and rural.